Monday, December 25, 2006

Year-End Tax Tips

1) Pay as much as possible as a charitable donation -- If you are Mormon this means paying your tithing in full before Dec. 31st. If you are not Mormon and living in Utah, take advantage of the situation by donating as much as ten percent to a charity of your choice. The culture in Utah offers an opportunity to donate a higher percentage of your income without increased audit risk as opposed to other parts of our nation.

2.) Pay future deductible expenses before Dec. 31st -- prep state income taxes, January's mortgage, and tithing. By doing so you can deduct expenses now that would be incurred in 2007. There is an AMT trap regarding early payments of state income taxes, and paying January's mortgage early. Consult a competent tax consultant.

3) Business owners should make inventory/equipment purchases before Jan. 1 -- Making such purchases before January 1 offers a wider variety of alternatives to lower taxable ordinary income, including the use of the accelerated depreciation deduction.

4) By a Hybrid/Qualifying energy efficient vehicle -- hybrid still offer great Federal breaks to business owners and individuals. There is no longer a tax credit for the purchase of a Toyota Prius (credits were limited to the first several thousand vehicles sold).

No strategy is right for all taxpayers consult a competent professional on whether any of these tax strategies are right for you. Competent tax advise can keep the tax tail from waging the economic dog in your finances.

Tax Reform/Relief -- Revisited

""If we a) want a tax cut package that directly benefits lower as well as higher income brackets, yet b) find it unwise to completely delete the tax on food... what other options should we be considering?"

While I am appreciative of the tax cuts that the legislature has passed, I believe there has been many viable options that have been balked at.

-- The Governor has a flat tax. Tax relief for the upper class is signed and delivered. (If anyone needs my analysis of the flat tax as a break for the rich, I invite a visit to my blog archives for an exhaustive review)

-- The rate drop to 6.98% from 7% is nice, but could have been more friendly with brackets that are actually in a real income range (11,000 is where the top bracket phases in). True tax relief for the lower and middle class could benefit from some smaller implementations of a few Federal tax breaks (family friendly Child Tax credits, Saver's credits for lower-middle class families who save for retirement, and a smaller version of an Earned Income Credit for low income wage earners)

Once more I appreciate the steps taken to cut taxes in this state, however a broader effort could have been made to offer real tax relief to the middle and lower income taxpayers. The wealthy definitely pay there fair share and deserve some relief, but not at the cost of those who are less able to pay taxes.

Lastly, our State Tax Commission does a masterful job at collecting tax, but I believe they should have some reigns put on their tax collecting power. The Federal government requires the IRS to collect tax debts within 10 years, and requires the IRS to accept all reasonable offers to settle outstanding tax debts. The State of Utah has put no such reigns on the power of Utah State Tax Commission. As a tax practitioner I have seen many gross abuses of this power against taxpayers (in one case even breaking federal law that disallows liens to be placed against active duty soldiers). There needs to be operational reigns placed on the Utah State Tax Commission. "

Of all of the above suggestions listed, I would like to strongly recommend stronger operational reigns being placed on the Utah State Tax commission. The Tax Commission operates without a collections statute of limitations, and therefore has little incentive to truly consider offers to settle outstanding tax debts. One solid break the legislature could give to Utah taxpayers is a taxing authority that operates a little more fairly.

Monday, December 04, 2006

"Preying On The Troops" Payday Loans Prey on Soldiers and the Poor

In the tax realm, the

Better still, it appears from the DesNews article, an effort to regulate this industry in Utah maybe thwarted by Legislators who lacked the moral integrity to refuse campaign donations from such charlatans. I would be very interested in finding who has accepted

Sunday, December 03, 2006

The Redistricting Committee Agrees on a Map with "Stunning" Bipartisan Support

I got this email on Wednesday regarding the map that would be recommended to bring in a fourth seat for Utah.

"The Redistricting Committee agreed on a map this morning with surprising (some would say stunning) bipartisan support. It doesn't answer the constitutional questions, but I thought you'd be interested in the update."

This map seems reminiscent on the map that SLCSpin was so displeased with earlier in the year (I would link Ethan's posts, but alas I'm too lazy this Sunday morning). I actually have no objections to boundaries that have been drawn up. I don't see a problem with having one specific district setup in which Democrats can enjoy better chances in this red state, although the new district 2 could foreseeably be too liberal for Matheson.

I still feel that pursuing our fourth seat via a D.C. congressional seat compromise, is selling our states best interest short. The only thing that could change my mind on this is if the soon to be Democrat controlled Congress will push the D.C. seat regardless of whether or not Utah supports the compromise (if we can beat it than we might as well join it philosophy) otherwise I think it would be wiser to back off until after the next census results around 2012.

Wednesday, November 29, 2006

Former Utah State Tax Commission Economist Makes Surplus Estimates That The State Refuses To Make.

All of this is unofficial because the officials over at the tax commission refuse to give public estimates.

"they didn't believe such estimates -- without Macdonald's work -- were reliable."

It is frustrating that such a tax rich state refuses to show more accountability of tax funds. It was interesting in one of my earliest staff meetings in the accounting firm that I currently work withcolleaguegue presented a federal report regarding tax collections and government spending. I naively asked where is the report from the state of Utah. "Other than the TC-23, there isn't anything so in depth," was the reply I got -- then the state dropped that as well.

The State Tax Commission needs to at least bring back the TC-23 -- and add much, much more to it! In my ideal world, I would like to see much more analysis of where tax dollars are spent. I would also like to have more information on the budgets of respective state government agencies.

Tuesday, November 28, 2006

Rocky Says He Will Have An "Open-Mind" Regarding Skybridge

The DesNews had an article this morning on Rocky's fear that a skybridge in the new Downtown plan being pursued by the LDS Church might threaten downtown vitality, but that he is "softening" his opposition. This was my favorite part of the article "Anderson said Monday that the council has the final say, unless he vetoes their decision." I guess he is either, giving a lesson on our system of government (the legislative branch (city council) votes, and the executive branch (Rocky) either signs off or vetoes the proposed issue), or he is unofficially planning a veto if things don't go his way.

After a tenure as mayor that has done nothing of substantial benefit for Salt Lake City (other than the little orange flags at street corners for the Olympics, national political activism, and acrimony between his office and the state legislature) he now asserts himself adversely when a real solid plan for urban revitalization is being introduced. He stated that "no one seems to have fully considered or analyzed the tremendous amount of time and the comprehensive public policy" that went into the '90s-era plans". Last time I checked the 90's era plans have left downtown SLC a graveyard of failed businesses and empty shops, one key to good government and good leadership is the ability to adapt when one plan fails other options need to be pursued. Rocky seems to lack this trait, he has failed to act in the city's best interest on countless occasions.

I don't care for Rocky Andersen, but I will admit that I will miss his antics, he has made politics in this state a much more interesting topic. However, Salt Lake City will be better off (at least economically, and managerially) when his tenure finally comes to an end.

Monday, November 27, 2006

Wednesday, November 22, 2006

Apparently Politics is Not As Interesting As Kramer

Maybe Green Jello needs to focus more time on Hollywood scandals, or maybe a frontal lobotamy would be nice instead.

In case you missed the awkward Letterman apology, here is video from iVillage.

Monday, November 20, 2006

Utah's 4th Seat

Wannabe Alienated has laid out some very solid arguments against the bill. I think that we as Utahn's need to stand against this. It is folly to push for a nullified 4th seat by giving a seat to a territory (which is unconstitutional) especially when it is highly likely (almost a certainty) that Utah will attain a 4th seat in a few more years after the next census.

Say it Ain't So Kramer

I was an insanely loyal Seinfeld viewer as I grew up, and Michael Richard's performance as Kramer was a big reason why. I'm not sure that I can watch old Seinfeld episodes now without feeling a little surreal knowing what kind of man Michael Richards is. His tyraid may even be enough to stop me from buying anymore DVD 's of Seinfeld.

Too bad that Michael Richards didn't sit back in retirement and live off of the millions of dollars that Seinfeld is making in royalties. He obviously isn't cut out to handle the stand-up comedy circut.

Friday, November 17, 2006

Apology for the Deleted Utah Porn Ranking Post

Full Employment and The Minimum Wage

As a brief history and analysis of the EIC, I quote the entry from Wikipedia:

"Enacted in 1975, the then very small EITC was expanded in 1986, 1990, 1993, and 2001 with each major tax bill, regardless of whether the tax bill in general raised taxes (1990), lowered taxes (2001), or eliminated other deductions and credits (1986). Today, the EITC is one of the largest anti-poverty tools in the United States (despite the fact that income measures, including the poverty rate, generally do not account for the credit), and enjoys broad bipartisan support."

The structure and benefit that the EIC provides is as follows:

"Currently, for a family with two dependent children, the credit is equal to 40 percent of the first $10,750 earned, plateaus at a maximum credit of $4,400, begins to phase-out when earnings increase beyond approximately $15,000, and reaches zero when earnings pass approximately $35,000. For filers using the Married Filing Jointly status, the phase-out thresholds are increased by $2000. For a family with one dependent child, the structure is similar but has a phase-in rate of 34 percent and a maximum credit of $2,604. For those filing without dependents, there is a small credit of 7.65 percent of earnings with a maximum of $399, which covers the employee's portion of the social security and medicare payroll taxes. All dollar amounts are now indexed to inflation."

In the cases where a family of four is actually living on wages of $15,000, and therefore qualifying for the maximum earned income credit, utilization of the AEITC would increase monthly income from 1,250 to 1,617 dollars. For a family of the same size that is actually living on 5.15 an hour income would increase from 893 to 1,251 dollars a month -- an hourly increase to 7.21 dollars. On paper is appears to provide nearly the same benefit, except if you forget that an actual wage increase to 7.25 an hour would move a given wage earner to 19000 a year in actual wages instead of 15,000 dollars a year in actual income.

So I would actually argue that a increase in the minimum wage and better utilization of the advanced earned income tax credit, would be the ideal means of giving the poor a living wage. Although realistically it should be noted that 19,000 dollars a year as a living wage for a family with four children is far from a living wage, maybe another means of giving a living wage would be initiating an Advanced Additional Child Tax Credit -- a Bush administration tax provision that allows for unused child tax credit to be refunded to those within earned income and investment limits. The most costly part of such proposals is implementation, calculation of AEITC is fairly complicated and thus far highly underutilized, it would take a solid commitment of the IRS to help educate the public of the benefits of such tax provisions.

If you are living on incomes of 5.15 to 7.25 dollars an hour check with your employers about the Advanced Earned Income Tax Credit, it could increase your monthly income substantially.

Wednesday, November 15, 2006

Chairman Rangel and the AMT

Here is a brief history of the AMT, the Democrat ran 91st Congress enacted the AMT in 1969 following testimony by the Secretary of the Treasury that 155 people with adjusted gross income above $200,000 had paid zero federal income tax on their 1967 tax returns. In inflation-adjusted terms, those 1967 incomes would be roughly $1.17 million in today’s dollars. This tax avoidance by a few high-income taxpayers was widely perceived as unfair. Rather than directly addressing the problem by eliminating the deductions and credits in the tax code that were leading to the tax avoidance, Congress laid an additional layer of complexity over the regular income tax in the form of the AMT.

Congressman Rangel claimed in his interview with Hannity that his main focus as chairman will be "fixing" the AMT. Depending on what he means by "fixing" the AMT, I am rather impressed at his commitment to fix on of the most poorly conceived and uninsightful parts of the tax code. The AMT, because of how poorly crafted the law was, is now growing closer to affecting several million Americans (because of 155 Americans in 1967) whom the 91st Congress never intended to burden with this tax. I look forward to see how the Ways and Means Committee addresses this issue.

I still am concerned as to what portions of current tax law that the Democrat Ways and Means Committee will seek to repeal in order to raise revenue and or make the changes that Rangel claims need to be made. I would solidly argue there are many individual tax cuts that need to be made permanent are the child tax credit, the higher standard deductions, the home mortgage interest deduction, and a large host of individual deductions. The issues that the Ways and Means Committee need to focus on in regards to revenue raising, are giving the IRS the needed funding to increase enforcement, customer service, and collection efforts. I strongly hope that this Congress will focus on fixing issues that need fixing (such as the AMT) and solidifying postive tax law changes that have been made during the current president's administration.

Thursday, November 09, 2006

Democrats Take Control of Congress

I'm hoping that this Democrat run Congress does what it claims it will do -- work with the GOP and the President. I am yet skeptical as to how the power change will effect the war in Iraq and American security, but I will have an open mind.

Tuesday, November 07, 2006

"I Voted"

Listening to news reports, I'm feeling more confident in my predictions of voter fraud allegations if Democrats don't win as many races as they think they should. I usually scoff at conspiracy theorists voter fraud allegations, but I can see potential problems with the age of the poll workers. Seniors and computers as a whole don't mix too well (oops I'm stereotyping aren't I).

Saturday, November 04, 2006

To Vote and How to Vote, that is the question

Despite my inability to reconcile my sociopolitical views to Ashdown's platform, I have committed myself to vote Ashdown. As in the words of my father-in-law, "it is the only message that I can send to Hatch." Although I agree with Pete Ashdown on a very limited number of issues, I believe he will be a true representative of Utah and not his only his political party. Hatch has long since trashed his connections to his constituents for highly visible party leadership positions. He reminds me of a narcissistic lover in a doomed relationship who recounts all of the hardwork the person has put in to be successful, attractive, and popular, with the endline "I did it all for you, baby!" When it is clearly obvious that all that work is for egomaniac himself. Hatch, you have had a impressive career, but lets be honest everything has to do with you and your political visibility even if occasionally you let the dogs (Utah) eat the scraps off of your table. I have delusions of an Ashdown victory, Utahns are too fond of incumbants (especially those deeply entrenched), Hatch will win another term and possibly reach his retirement point after this term. Hopefully in another six years we will finally have a contested race for Hatch's Senate seat.

Regarding the other national vote between Matheson and LaVar, its is pretty difficult to differentiate between the two of them. They both act like Republican's, ones a moderate (who should change party affiliation) and ones a conservative. The problem with the two choices is official party affiliation. Although Matheson has done well representing the views (as a whole) that I hold, his affiliation as a Democrat maybe critical if there are a significant number of Republican seats that are lost in the House. I can't believe it, I am actually leaning towards LaVar Christensen if only to pull one more seat on the Republican side of the isle. I really can't differentiate between the two of them anymore, one candidate is truly a Republican (even if not that impressive) and one candidate is an imposter Republican. Moral for Jim Matheson: if you are going to run a campaign on Republican ideals, you might as well become a Republican.

My hopes for the election nationally, are that the Republicans hold both houses (at worst loose the Senate) without the senior senator from the state of Utah. My predictions are that the election will be too close to call, and many elections will be contested by Democrats on accusations of electronic voting machine fraud. The final result in some races drag on for weeks. (or everything may run smoothly)

Get out and vote.

Tuesday, October 31, 2006

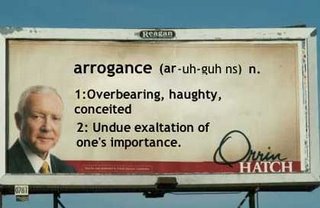

Everyone is Thinking It

This is sweet satire. I saw his billboards last time I was in SLC and thought the same thing.

If my unofficial polling is any real sign of how the voting will go -- for him it isn't great. Everyone I know is either going third party or Ashdown.

I'm still not sure how I'll vote on this one. I doubt I can stomatch pressing his name on Nov. 7.

Sunday, October 29, 2006

Religion and Politics -- SLCSpin

Regarding political campaigns and candidates, it is absolutely illegal for the LDS Church to endorse a political party or a candidate. Hence the church, every year, has the same letter announcing political neutrality read over the pulpit near election time. This is the church's official position and a disclaimer. The organization is forbidden from creating ties to parties or candidates. This is a point that is firmly established.

From this point on the water gets a little muddied.

In the same letter, individual members of the church are encouraged to participate in the political process. I'm inclined to believe this letter means all members of the LDS Church. Ethan had an issue with the president of the MOTAB Choir (Mr. Mac) being a campaign worker for Hatch. My question and issue with Ethan's argument is this: at what point should an individual's position in the church, force that individual to refrain from open support of a political campaign or party? I feel cases like this should only occur in cases like that of General Authorities, where an individual is fully and completely tied to church leadership and management. (All of my argument rests on the assumption that LDS members show respect for the neutrality policy the Church holds, which is sadly not the case sometimes)

The other issue where people look beyond the mark is in regards to the Church's lobbying activities. Lobbying is allowable under IRC Section 501(c)(3) (the tax exempt organization rule book)if a charity is lobbying on political legislation that it deems critical to the organization's mission and purpose. If you pay attention to the issues that the church openly lobbies they are always issues that are connected to LDS Church doctrine. In 1995, the church issued "The Proclamation on the Family" which served as a firm pronouncement of church doctrine, and gave the church greater ability to lobby against gay marriage without violating IRC 501(c)(3).

UPDATE : Ethan made a second post on the issue that made one very solid point "The LDS Church has always maintained its political neutrality. The problem doesn't really lie with The Church. I believe The Church is victimized by opportunistic politicians and also employees who do not understand the consequences of their actions." This hits a major part of the problem on the head, so the solution lies with the church making firmer policies with employees and employees emails, establishing what church leaders should refrain from visible political activities, and more solidly establishing its political neutrality among church members.

Friday, October 20, 2006

Tax Season Over & A Few Weeks From Elections

I really don't want the Democrats in control of the house, mainly one committee -- The Ways and Means Committee. I love how many Democrats use a silly rhetoric regarding tax cuts -- "tax cuts only for the elite wealthy." This is false, and an open invitation to anyone who would like to have a lesson why. For the purposes of this post, I will simply say that nearly everyone of my clients at any income level has benefited from the tax cuts that have been around due to the current administration. The budget problems in Washington don't start with tax cuts, they start with spending!

Let us start with the senior Senator Hatch. This race is pretty much a vote where I cannot win. I wish a suitable Republican candidate could have made it to a primary, so at least I could have had a choice of a candidate in the party with which I choose to affiliate. That hope faded when Urquhart could not get the needed funding to fight Hatch. I have tried to hop on the Pete Ashdown parade, but couldn't get my heart behind a platform for which I had only a few points that I agreed with. So the decision I have left is to vote for Ashdown or a third party candidate, which is vote same thing, a step closer to a Democrat ran legislative branch. The other choice -- vote for the devil and hope that Hatch either has a stroke, retires, or gets embroiled in a scandal that forces his resignation. The choices are certainly bright on this one.

I am still firmly behind my congressman, Jim Matheson. However, I think he ought to consider leaving the Democrats. It is obvious that his support of Bush is too much for many Rocky Andersen/Cliff Lyon-esque "he ain't liberal enough" local and (I'm sure) national Democrats. On the other hand, I think most right-minded (an oxymoron for some I admit) Republicans would accept him as a moderate candidate. It has been rather pathetic to watch Lavar Christensen lame "Elect me, because I am warm body that claims the Republican party as its party"campaign. However, I have seen a large number of my neighbors putting out Christensen yard signs. Interesting, Interesting, hmmm.

On a local and municipal level, I will probably vote solidly Republican. I'll admit I haven't had much time to research my local candidates, I probably need to spend the next few weeks reading the voter manual that has been gathering dust on my counter.

I still get to vote for Steve U. at a local level -- HOORAY!

Just as a final note for anyone who wants to use Iraq as there ace in the whole, let me comment now. Iraq is a mess! I admit it. I've said often that I believe that this is going to be a difficult long-term commitment for which our nation probably doesn't have the fortitude to see to the end. The rightness or wrongness of the initial invasion is now irrelevant (at least to me) because we are already there. The choice that remains, is do we abandon Iraq now or do we keep trying to help a fledgling democracy survive. I'm not sure which party is best at answering this question, but I feel more comfortable with the Republicans so far.

As a stomach churning note, the Washington county Republican party really needs to act like at least a handful of people in this county have brains. I just heard a radio ad and it was the most condescending tripe I've ever heard. I felt like I was either a three year old or the only un-brainwashed person in an island of drones. Crap like this from Republicans, makes it embarassing to call myself a Republican.

Sunday, October 01, 2006

Hatch and Employees -- or Not Employees

IRS and State Guidelines have a handful of simple tests.

1.) Does the boss have significant control over how and when work is finished, and are they paid passed on time not work finished? I'm guessing that there is a least one employee who is expected to show up every day and work a solid eight hours. It seems from the article that many fail this test.

2.) Is the worker free to perform the same work for other clients? This means Hatch's subcontractor campaign manager can (and should) go work for Ashdown as a aide for Hatch's argument to work. I'm guessing that the contract between Hatch and Hansen does not allow for this kind of extra work. A subcontractor has no fiduciary duty! If an aide of Hatch wants to contract with Ashdown they can take campaign secrets with them to the opposition. I'm guessing that Hatch fails here, however this maybe a opportunity for Ashdown -- Subcontract with Hatch aides.

3.) Whether there equipment is provided or they have invested in their own equipment? I have no idea on whether Hatch qualifies on this issue. For me to sign off on his aides being subcontractors, I would expect that they not only provide their own computers but also all the campaign materials they distribute. I'm guessing many of his aides would fail this test in audit as well.

4.) Whether the worker is reimbursed for expenses or whether they are responsible for expenses themselves? The article claims that financial disclosures show many reimbursements for aides expenses.

5.) From Utah DEWS: Whether or not the contractor has proper business registration and licenses? City business licenses as well as state debase. I'm guessing all fail on this point. I did a business search for Dave Hansen, Hatch's campaign manager, and I found no likely business registration for his subcontractor campaign manager.

I cannot believe that a competent tax attorney would support such a position that Hatch has taken. It is colossally unfair for Hatch to do this, it is unfair to his opponent, it is unfair to his aides who are stuck covering taxes that should have been paid by Hatch's colossally large campaign coffers.

When I have clients that come in who have had employers use this (black area) aggressive tax position usually suggest the client turn the employer in. There are four phone calls that could cost the Hatch campaign heavily in fines and interest.

Utah Labor Commission (801) 530-6800

Utah Department of Workforce Services (801) 526-WORK

Utah State Tax Commission 1-800-662-4335

IRS

It is another verification to me that Hatch needs to go. I have client who call me and ask me to tell them it is okay to call employees, subcontractors and almost always (unless the circumstances pass State and Federal guidelines) say no, it is illegal, it is unfair to your competitors, it creates large legal liabilities, etc. I'm so grateful for honest public servants like Hatch who make convincing people to follow the law because of their example so much easier. I wonder how Hatch answers in that temple interview question "Are you honest in your dealings with your fellow men?"

Tuesday, September 19, 2006

Thailand in Chaos

I served an LDS mission to Thailand and I truely (I know it sounds cheesy) loved those people. These people would bend over backwards to make sure you were comfortable no matter how poor and dilapidated their living conditions were, and I don't think there are a more (non-Christian) Christlike, loving people on Earth. I really hope that the major strides towards open religious policies over the past several years will not be eroded. Some major allies of Mormonism and Christianity were in the overthrown government, and I pray that the voices that were friendly to Thai Mormons won't be silenced.

I hope that everything works out all right. Please keep the Thai people in your thoughts

Tuesday, September 12, 2006

Signing Off Until After October 16th

See you all later

Helpful Links

IRS

Utah State Tax Commission

National Society of Enrolled Agents find a true tax expert in your neighborhood. (shameless plug)

Ed Zollars Tax Update for interesting tax discussions oriented to tax professionals.

Monday, September 11, 2006

9/11 Five Years Later

SLCSpin has a list of other blogs who have recollected on personal memories of 9-11. Feel free to share your memories here, and follow this link to SLCSpin and read some of many thoughts from that awful day 5 years ago. We all have one thing in common we will never forget, and we all remember it like it was yesterday.

GOD BLESS AMERICA, and GOD BLESS THOSE WHO LOST THAT DAY AND SINCE.

Wednesday, September 06, 2006

DesNews -- A Refreshing Approach to the Office of Salt Lake Mayor

"We need a mayor that is willing to work with all sides, I think that we're at a time in the city's history where establishing relationships is absolutely key. Frankly, that's a different leadership approach than our current mayor." "I won't be organizing rallies for any national cause, I have a greater interest in spending my time on the business of running the city."

Wow, a mayor focused on the affairs of the city, that sounds like a great idea.

Tuesday, September 05, 2006

Kearns High School -- Class of 1996

At the picnic I saw a lot of people whom I hadn't seen since graduation. It was interesting to watch old personalities jump out. I found myself quickly assuming the former role of class clown. I was impressed at the paths my classmates had taken, many had graduate degrees or were in the process of doing so, some were working with very prestigious companies, all very remarkable for kids coming from a school and area that is largely dismissed as a "ghetto".

I'm married into a family where most of the kids attended Skyline, the sports equivalent to Notre Dame or Miami in Utah high school football. I've occasionally been teased (always in fun) this time of year by my bro's and father-in-law about my Kearns background. However seeing classmates who have made so much of themselves, I'd have to say I've never been prouder of where I'm from. Kids from my neighborhood may not have won in sports back in school, but they are winning the game of life as adults.

Forgive me for the nostalgia, it was nice to revisit old memories.

Rocky Andersen -- Too Legit 2 Quit

I grew up in Kearns UT which in Utah has a bit of reputation for being a rough area. I'm guessing everyone has seen behavior of little hoodlums who attack weaker peers in order to gain a sense of power and strength. This tirade of Rocky reminds me of the short, scrawny gangsta' kid who has, due to the incontrollable rage brought on by short man syndrome, become a part of the tough crowd. After the "chiquaqua" hoodlum becomes one of the crowd he is the loudest barking and most vicious defender of his position as a hard core gunshot'. Rocky, who has become a part of the hard core liberal crowd by being a extremely vocal voice of opposition to conservative Utah, thus decides he needs to attack a winning Democrat like Matheson who seems to threaten him by doing a good job of representing his constituents and who actually seems to use thought and reason in his policy decisions.

I don't know if anyone else sees the parallels, but I had fun with it. I'm grateful for politicians like Matheson, who have moral courage to vote the dictates of their hearts. I keep hoping that voters on both red and blue sides start to reject extremists politicians who have no original thought of their own, only the talking points from their respective parties (Rocky and Hatch).

Rocky has quit, please follow suit Senator Hatch.

If I misunderstand the story please correct me.

Tax Reform, The Finished Product?

Then the Governor suggested the idea of a dual tax system, which I initially was not fond of, however I have changed my opinion as information has turned up. The flat tax which will turn up benefits for the wealthy and the poor will be used, as well as stretched out brackets and a reduced top tax rate for the regular system which is most benefit the middle class is available. This policy seems like beneficial tax policy for Utah taxpayers across the spectrum of Utah incomes.

I appreciate the innovation which the Governor and the Legislature have shown in coming to this new tax proposal. Although I'm not sure this tax system is the best system, I believe this will be a meaningful tax cut for the majority of Utahns. I'm excited to see tax cuts from Utah.

Thursday, August 31, 2006

Thank you Rocky, Ross Andersen

So I thought I would give my thank you as well.

Despite the fact that I have despised nearly all of your views, many of your policies as mayor, and the "in-your face" conduct, I must thank you as well. The disdain I have had for you as a politician and as an activist, has made me be more thoughtful and active in the participatory government we have in America. I think your views are wrong for our nation, state, and your city. However, your passion makes people stand up, listen, and think, that is a much needed contribution to our style of government and society.

I whole heartedly disagree with you on almost everything, but it would be un-American to stand with the McArthy-ites who believe exercising of the first amendment is un-American or embarrassing. You are an American -- not my favorite, but American.

Blogger has tagged me as a Spam Blogger

I think I may need to switch to Word Press or something.

Part of the Plan -- Secretly a Bush Speech Writer?

In other useless news, the Tonight Show had a rather remarkable lookalike of the President on.

Wednesday, August 30, 2006

Salt Lake Trib Blog: Death To Israel Protest "Not Anti-Semitic and Gutsy?"

"You may not support his cause, but Robert Breeze is probably the gutsiest protester in Salt Lake City today. Breeze is leading a "Death to Israel" rally at the City-County Building's Washington Square. He makes one thing perfectly clear: he is not an anti-Semite."Do I look like a member of the Aryan nation?" he asks. Dressed in shorts, suspenders, and a straw hat, Breeze looks, well, just goofy. Breeze's message is simple: Israel has subjugated and brutalized the Palestinian people for decades under the cover of America's "corporate media."He has only one person with him at 10 a.m.. But Breeze freely acknowledges he has sent someone else to hire what he called "surrogate protestors" at $10 an hour."A lot of wealthy people don't have the time to stand out here, but they are more than happy to pay someone," Breeze says.Meanwhile, across the street, a dozen pro-Israel demonstrators have gathered with Israeli flags. They seem to be more baffled by Breeze than intimidated.Michael Pack is a Salt Lake City Jew who felt compelled to carry the blue and white Israeli flag today."I lost a lot of family in the holocaust," he said. "To sit around and do nothing was something I couldn't do."When asked if he was bothered that he has offended many area Jews, Breeze says: "Too bad for them, it's a free country. Tell them to have a 'Death to Wales' rally and see if I give a shit.' "

So does this make sense to anyone, a man running a "Death to Israel" rally isn't an anti-semite? What in the heck!?! (I promised my wife I would stop cursing) Let's at least be honest here Glen Warchol, a man who shouts "Death to Israel!" is an anti-semite. He has a right to protest...even the KKK has a right to protest. However, let's call a nut-- a nut, and an anti-semite -- an anti-semite.

Don Dolan

America is hard, it requires sacrifice, service, involvement, and courage. I think all Americans need to reflect on sacrifices of our dead servicemen and ask ourselves what is our resolve in supporting the cause of freedom -- I know I am. I'll admit that I have never served, but I wonder if the best policy for our nation might be a draft or mandatory military service so that the price of freedom may be shared by more Americans than just the few and the proud.

Tuesday, August 29, 2006

One Utah -- What Terrorist Want.

Do we drop our guard and go back to a care free pre 9-11 state of mind, or do we accept Bush administration rhetoric that we must allow the government to wiretape without warrents, and to strip personal freedoms in order to avoid violence or death. This dilemma reminds me of "I, Robot," Bush is the Main Robot who discovers a paradox in its duties and thus reasons that in order to protect and defend the nation and the constitution of the United States, some parts of the constitution need be ignored and personal freedoms need to be stripped to keep the American people safe. I think (in part) our country is being ruled by fear, but I don't think that that fear should be ignored.

We must remember that the terrorists do seek for attacks that are as bloody and terrible as possible, and they do consider the size and quantity of the damage and death as an important factor in planning terror attacks. Closing our eyes ignorantly to that fact would be highly dangerous. I don't believe that we should abandon the War on Terror in Iraq or Afghanistan, and I don't believe that their was any reason for the war in Iraq other than we had intelligence that led our leaders to believe to a reasonable (though flawed) certainty that Iraq was trying to attain WMD's. With an increasingly dangerous Iran, it would be disasterous for us to leave Iraq before the Iraqis are strong enough to govern and protect themselves. We must be careful to fight terrorism to keep American lives safe, but I think its a tragedy that many American's seem to be living their lives ruled by fear -- fear of terrorism, and an impending apocalypes from any one of several directions.

Saturday, August 26, 2006

Back from the IRS Nationwide Tax Forum

Three Goodies

1. HYBRID VEHICLES -- The tax breaks for hybrid cars shifts from a adjustment to a credit. Hybrid credits this year range from the Toyota Prius at $3100 to a Chevy Silverado at under $1,000. While the Prius as we all remember gives a tax break of zippo in Utah, the Toyota is the best for a Federal tax break IRS.

2. IRA DEDUCTION FOR SOLDIERS WHO HAD NONTAXABLE COMBAT PAY -- Soldiers who had nontaxable combat pay for 2003, 04, and 05 limitations on what they could put into their IRA's. The Hero Act will allow them to count combat pay as earned income overcoming the limits and allowing soldiers to make IRA contributions for any of those tax years until 2009 and the can amend tax returns to take the deduction.

3. EXEMPTION PHASE OUT TO BE PHASED OUT -- For 2006 the amount of phaseout for personal exemption can be phased out only by 2/3 of what the original amounts would have been. The wealthy who used to get 0 for personal and dependancy exemptions now get 1,100 per exemption. The rich can now get some tax benefits for their dependants.

Three stinkers

1. KIDDIE TAX NOW KIDS UNDER 18 FROM 14 -- As a revenue raiser from TIPRA, Congress raised the age for the kiddie tax to 18 from 14. This tax change blows many tax strategies out of the water for high income taxpayers who have been anxiously awaiting the 14th birthday of their children. The kiddie tax initially was made to close a income shifting loophole in the tax code that allowed parents to shift investment income between children in order to pay less tax at their children's lower rates.

2. TUITION AND FEES DEDUCTION PASSES AWAY -- This provision that allowed students an extra method of deducting college expenses besides the two education credits rode off into the sunset.

3. STATE SALES TAX DEDUCTION DIES -- Another provision of the tax code that sunsetted last year. Ridiculous as it may be, you are once again only allowed a deduction for income tax paid and not sales tax paid. It is silly that income tax is only allowed preferance as a deduction when both taxes cut into the income of American taxpayers.

The Dumbest Tax Law Change

NO CHARITABLE DEDUCTION FOR DONATED UNDERWEAR -- Yes its true in case you were wondering, you can no longer donate used underwear and get a deduction. I guess I'll have to throw those old boxers away! Congress actually debated this issue. The speculative rumor is that this provision is a slap on the hand to Clinton who donated underwear and wrote it off.

This should be a fun week with the President in t5own, and the Rocky Andersen freak show.

Monday, August 21, 2006

Rocky Andersen, Cindy Sheehan, and the Democratic Party's Achilles Heal

I believe there is one important problem that Mayor Andersen's protest creates, (problem for Democrats) bringing a extreme leftist like Sheehan to the state will be viewed by many Utahns as a validation of the common perception among pulpit politicians that the Democratic party is the party of extreme leftist. Rocky Andersen's leftist policies and actions have been well received in SLC where the most solid Utah liberal Democrat base exists, but here in right wing St. George he is viewed as extreme left as Gloria Steinem, or Jane Fonda. Unfortunately that perception is easily carried on by many Utahns to the rest of the Democratic party, although some Dem's like Jim Matheson has overcome that perception, overcoming that perception isn't easy.

Rocky Andersen is likely to be the biggest liability for Utah Democrats in Novembers upcoming election. Anyone running for office in precincts outside of Salt Lake should distance themselves as far as possible from the lame duck Mayor.

PS Part of the Plan has an excellent post about the negative impact of the August 30th protest. Having never been a soldier myself, I could never adequately express what he says in his post.

Saturday, August 19, 2006

Southern Utah Blog : "Leave the Leavitts Alone"

I was reading the new Southern Utah Blog and I read a post that made me scratch my head, Gloria Bertram of the Daily Spectrum writes regarding the Leavitt Foundation the following:

"The Leavitts have a foundations and they also have rental property.

Their foundation is providing housing scholarships for SUU students. There is another foundation in the middle of this but the end result is that the Leavitt Foundation is providing the funds. The students that get these scholarships are staying at some of the Leavitt's rentals. So the money goes full circle. And here are my thoughts: So what?

2- The Leavitts are giving the money through their foundation.

3- The Leaviitts are making less money by renting it to students at a "below the market" price, while they could be renting them full price somewhere else!

4- The university has the option to rent somewhere else but chooses the Leavitt out of price and convinience (only one rental contract instead of 12).

5- They are not breaking any laws. They are giving more to the community that what they are getting back. Maybe this is not the case in other areas of their business but it is in this one.

I don't have an issue with this, those that do, please explain.

If the Leavitt Foundation is providing scholarships, and the Leavitt Rentals are providing below market price and convenience, it sounds to me that it is just a good decision from the University standpoint to rent from the Leavitts."

Does anyone else see the problem with Ms. Bertram's thought processes here? As a tax professional I have two major problems. The Leavitt Foundation has as far as I can see been more of a bank for the Leavitts other business ventures than a charity. The Leavitt Foundation with the meager donations that the foundation made, made the donation to a foundation that gave housing scholarships only to SUU students which (not only by circumstance as Ms. Bertram would like her readers to accept) would be used as rental income to another Leavitt owned business. Lets open our eyes, The Leavitt family took substantial charitable deductions to an organization that non-arms length loans to family business, and also received income from money that was also used as a charitable deduction. Can we say abusive tax scam. However, Ms. Bertram as many Southern Utah-ites turns a blind eye to the fact that the Leavitts obviously engaged in (at least) unethical transaction for the sole purpose of tax avoidance. I wouldn't mind if my tithing generated income to me, but oh wait, that's not the purpose of charity is it.

This type of status quo mentality (that exist in the minds of the politically lazy) is the only thing that stands a chance of keeping Hatch in office. Open your eyes So. Utah!

Friday, August 18, 2006

IRS Goes After the BLING BLING Hollywood Gift Bags

I guess that I'm supposed to be impressed at the fairness of the tax system because the IRS has decided to finally tax multi-millionaire movie moguls. Kudos to the Internal Revenue Service.

Thursday, August 17, 2006

Hatch -- Electing a Democrat is a Vote for TERRORISTS

We need politicians that can look at issues openly and honestly. Hatch and Chris Buttars seem to have the same level of critical thinking -- if Rush Limbaugh or Hannity says something we should bring it up on the Senate floor. Hatch is as far to the right as Kerry is to the left, they are tied so tightly to extremist portions of their parties that they cannot provide an ounce of innovation to solve the problems of our times.

I can't stomach Hatch anymore. I don't agree with Ashdown on several issues, but I know that he will at least be critical (and hopefully innovative) in his analysis and approach to issues facing our nation. At least he won't waste time in the Senate promoting ridiculous legislation like flag burning amendments, or bringing ID into high school science classes.

Cindy Sheehan is Coming to Salt Lake

Personally, I think Sheehan is a joke. All that aside I think her visit will bring alot of attention to Salt Lake City, and if nothing else make the 30th of August interesting.

Thursday, August 10, 2006

Republican Party.... Not Just for Evangelicals

" 'I've actually been sober for five days now,' she said, adding that she intended to give up alcohol until election day in November to focus her energies on the campaign.

Carey's platform includes getting the FBI to 'leave porn stars alone' and concentrate on the war with Iraq and said that if elected she, like Schwarzenegger, would put her film career on hold while she served as governor."

I'm guessing this person needs some help in understanding what Republicans generally stand for. LOL though.

Wednesday, August 09, 2006

Ah Irony

Abortion

I have stayed away from association with the Democratic party in large part because of this issue. I can give credit where credit is due, there have been many suggestions such as better sex ed., increased access to contraception (although I'm not sure where in this country it is difficult to get a condom), insurance coverage for birth control, increased push toward abstinence, etc...from Democrats that have alot of potency in slowing the flood of unwanted pregnancies. However, why do we need abortion.

If a pregnancy is unwanted there are several options that are viable opposed to abortion. For infants, there are many barren sets of parents that would anxiously snatch infants up for adoption. In the worse case scenario children may grow up in orphanages if they are abandoned, which one commenter sarcastically said "I'm glad you get to make the decision for the poor kid that gets thrown in an adoption slum because his or parents couldn't make it" I guess compassionate liberals feel it is better for a kid to be dead than to live in poor or depressed circumstances. Some may argue that kids in unwanted pregnancies may grow up abused or neglected, but I'm guessing kids in the worst slums would rather live than have never been given a chance and more effort needs to be made to help these kids make it -- not aborted. Some very successful Americans have come from "adoption" slums, lets ask them if they think it would have been better to be aborted.

We need a focus of sex ed. pushing towards abstinence, increased access to birth control, and increased access to contraception. However, all this does not mean we need elective abortions. It is hypocritical to dismiss prolife as religious pandering, Roe V. Wade is in opposition of the Declaration of independence, "the right to LIFE, liberty, and the pursuit of happiness.

As a post script, if abortion should stay legal, lets have some consistency and grant euthanasia to terminally ill people. After all, shouldn't they have a right to say what happens to their bodies?

Thursday, August 03, 2006

Politics -- Never Boring!

Mike Leavitt's family charity issue was exposed even more to discover that the little charity money that the Leavitt foundation gave, went to a foundation with ties to SUU as scholarship money which was directed back to the Leavitt family in the form of student housing rents in Leavitt family owned apartments. The Leavitts not only got a deduction but they also earned income on their deductions. The Leavitt family's "altruistic" dealings seem to get shadier and shadier.

Mitt Romney made a Perot-esque faux-pax in using the term "tar baby" I had not ever heard the phrase but it apparently has a double meaning, one coming from the story of Brer rabbit being a messy situation and the other in later years used by some as a slur for a black person. Taken in context it is obvious that Mitt meant the former and not the latter definition. Black leaders in the community were outraged! Come on people he was referring to a "messy situation," and I mean its not as if he used a phrase like niggardly. American oversensitivity continues to overstretch the bounds of reasonableness. I do wonder though if tar baby , combined with Romney Mormon roots, will be used as an issue should Romney get a nomination

The commanding U.S. General acknowledged and opined before a Senate hearing that the situation in Iraq could deteriorate into civil war and that sectarian violence as at its worst level. While I have for the most part been a supporter of the decision to go into Iraq, I believe we, as a nation, are approaching a crossroads. The war against insurgency in Iraq is one that will undoubtedly be almost unceasing (Gadianton Robbers comes to mind) along with the apparent "Hatfield and McCoy" violent rivalry that seems to exist between Sunni's and Shi'a's I feel certain if U.S. involvement continues in Iraq until there is a full peace the US may be in Iraq for at least a decade. Therefore we as a nation have major ethical dilemma approaching, do we continue sacrificing American soldiers in a nation that seems bent on self destruction, and if we continue, do we continue without a system of mandatory military service. This decision is going to be a critical and difficult one.

Personally I believe that with a nuclear Iran, leaving Iraq in the middle of political turmoil would likely amount to negligent homicide on that nation. This leaves with only one alternative -- mandatory service or the draft. It has been inspiring watching and hearing about the bravery our men and women in our volunteer military exhibit. However, it would be altogether unfair for this long-term combat commitment to be shouldered by the volunteers alone. Many of these soldiers have been over there two to three times, and have spent over two years away from their professions and their families. If we are going to stay in a conflict as long-term as it appears Iraq will be, then the burden needs to be shared by all able-bodied men.

Thursday, July 27, 2006

Religion and Politics -- LDS Church and Party Affiliation RELOADED

JTH said "Although I believe that politics from any party should not be discussed or preached, in a place of worship. I find even more disturbing when one party is given preference over others. Thanks for an excellent post. After reading all the comments in reference to this post, I have one question. Where is the IRS when you need them?"

While the LDS Church as an organization has come out year after year with statements of neutrality, members who preach political rhetoric do run the risk of getting the LDS church in hot water with the IRS as I discussed in a previous post.

The Church of Jesus Christ of Latter Day Saints is a 501(c)(3) tax exempt organization. Under Internal Revenue Code such an organization would and could lose tax exempt status if they are caught openly endorsing parties or campaigns....... This matter is one that the IRS watches very diligently and accusations are investigated regularly. If there was so much as a campaign poster seen on church property there would be consequences.

Food for thought for anyone who mingles their party affiliation with preaching form the pulpit, you maybe causing some headaches for the organization you profess to love. The IRS does encourage these types of infringements to be reported, and in severe cases an organization could lose exempt status. Although I'm guessing the church's legal department has had to deal with IRS inquiries of this manner many times.

Moral: Don't preach politics at church!

Tuesday, July 25, 2006

Mike Leavitt Once Again is Plagued by Accusations of Corruption

Leavitt's Secretary Christina Pearson made a statement that "the foundation's activities are totally legal and proper."However, Rick Cohen, executive director of the National Committee for Responsive Philanthropy, said that "the Leavitts are using the foundation as a personal piggy bank, and that's not what the public -- or Congress -- ought to tolerate." Use of "charitable" foundations are often abused as IRS Commissioner notes, "Some promoters in this area have encouraged individuals to establish and operate supporting organizations . . . that they can control for their own benefit. There are a variety of methods of abuse, but a common theme is a 'charitable' donation of an amount to the supporting organization, and a return of the donated amount to the donor, often in the form of a purported loan that may never be repaid."

For more fodder to the culture of corruption crowd, our former Governor and his family seem to be using this foundation as a tax scam. Although I don't know if they crossed from the grey into the black (criminal areas of tax law) it really adds to the evidence that former Governor and now Sec. Leavitt might have subscribed to an ethical paradigm of "as long as it is legal, it is ethical". This is another dismaying charge of corruption with the most prominent politician from Utah in the middle of it.

An interesting note in the story is of the few organizations that the Dixie & Anne Leavitt Foundation support one was the Western Association of Leavitt Families, which promotes genealogical research and religious activities for the descendants of the first Leavitts, who helped establish Utah as a Mormon state. Icing on the cake is Leavitt and his family's ability to take a deduction for doing personal genealogical research.

This case brings up the question how do I know who to give to? The best advice I can give is this, IRS approved charities have their tax returns open to public inspection and there are various websites devoted to giving information about US charities. I suggest researching out charities you are unfamiliar with before giving, and the safest thing you can do is to only give to well-known organizations.

Thursday, July 20, 2006

Religion and Politics -- LDS Church and Party Affiliation

I must concede that there are a fair portion of members of this state's majority religion who view their Church's statement of neutrality as a "wink and a nod" endorsement of the Republican party. This problem of course is one that comes because many people don't take the time to know what the party they affiliate with stands for, and use one or two issues to classify their political ideals. I have even heard one member hear go so far as to state that "How can a Latter-day Saint be a Mormon and a Democrat" simply because his pet issue (abortion) trumps all others in his political paradigm. I'm sure cases of narrowmindedness like this and others aren't isolated in Zion, although I hope them to be the exception an not a norm.

As the LDS Church's neutrality statement suggest both parties have views and positions that are in harmony with the precepts and doctrines espoused in Mormonism. As I have noted in the past the neutrality statement does have a legal reason for its existence, but it has a sound religious doctrinal purpose as well "members (and all citizens) should study and pray about the candidates" rather than blindly voting down one column of a ballot. I believe this sort of proactive participation is the democracy that the founding fathers had in mind when writing the Constitution, and not vote strictly per myopic, mind-numbing, black and white political paradigms in which many Americans exist. With that thought it may well be said that full and utter allegiance to one political party over another hinders the development and progress of our nation. Party alignment is necessary, however our commitment to democracy needs to be deep enough that we seek candidates who have positions consistent with right principles, and candidates who that stretch their positions beyond the narrow borders of party talking points.

Democracy is one of the greatest inventions in the history of the world, it is an invention that was inspired by God. With such a great gift from God there comes responsibility, our responsibility is to be engaging, thoughtful, prayerful, in the decisions we make when we go to the polls. May we as Utahns, Mormons, non-Momons, Americans stretch our voting decisions beyond party allegiances to learn and vote according to the merits of every candidate rather than the rhetoric and stigmas connected to respective political parties.

Utah Gov. Huntsman backs McCain over fellow Mormon Romney

My take on Huntsman's premature endorsement is this, he is a career politician/businessman and every new position he gets (i.e governor of Utah) is another stepping stone up the latter to the pinnacle of of his power goals. He will have served his first term as Governor, and that would be a good time to jump ship for a more prestigious position as either a member of a McCain cabinet, or (highly speculative) as a Vice-President. Huntsman, is betting on his horse now to gain favor with the man he sees conquering in the next presidential race.

His rejection of Romney is merely a verification that he sees Romney as being unelectable because of his Mormon roots. Which leads to another good question -- what are Huntsman's ultimate political goals? President? I wonder if he believes being associated with moderate McCain will relieve him of the stigma of being a Mormon politician.

Wednesday, July 19, 2006

Tax Reform -- The Pitch

The flat tax proposal, while still not my favorite I appreciate the effort to make the flat tax (at least) appear to be a viable option for the average taxpayer by allowing exepmtions for lower and middle class taxpayers. On the traditional side, the Gov's .1% top rate drop looks sexy on the outside but I would argue it to be less advantageous than the Legislature's version. Spreading the brackets out would allow for more taxpayers to pay in lower brackets as opposed to the current brackets. Current brackets are incredibly narrow, the highest 7% bracket is reached if taxable income reaches 8700 dollars for married joint filers -- so that generally means a vast majority of taxpayers.

I must applaude the Gov. and the members of the Legislature. While I think we need to be honest with ourselves Rep. Harper -- "big winners" are still going to majorly include the wealthy. However, this proposal looks like it may do an adequate job in spreading the cut across the spectrum of Utah taxpayers. I'd like to know more of the specifics of the proposal before I would fully embrace the deal. Any tax cut is better than no tax cut, I'm excited to see this progress.

Saturday, July 08, 2006

Political Schizophrenia -- Utah Most Conservative State in The Union, and One of the Highest Taxed

From George W. Bush to Ronald Reagan, we have all become well aware of "conservative" fiscal policy. "The economy is best served when citizens keep more of their money", this is a theory which I believe in. When people feel they have control over their pocket books they are more likely to go out and buy a automobile, give money to their United Way, and start a small business, etc. When people have the expectation, and/or know that the government may take a large portion of their income through taxation they are likely to hold onto their clunker automobile, give less or nothing to charity, and will stick it out in a 9-5 job that offers little chance of advancement. Supposedly, low taxes is policy that "Red Utah" would adhere to. However, with Utah beating out "True Blue" states like California and Massachusetts our legislature likely should take a hard look at themselves and ask what party are we supposedly aligned with? Maybe Democratic Party candidate in Congressional District 1, Steve Olsen, is right on target in his essay “Why Most Utahns Are Democrats and Just Don'’t Know It Yet”, the numbers at which our state levies taxes seems to point to that conclusion.

I believe in low taxation. When the government allows people to hold and spend more of their money, they will do many of the things that bring prosperity to our nation -- without the artificial economic stimulation or spending, and people will be more altruistic to private charities -- without threat of search and seizure. I hope that the Governor and the Legislature will seek tax cuts that are meaningful to all Utahns.

Thursday, July 06, 2006

Ure's defeat may mean end of tuition law

Notwithstanding Ure's defeat, this article brings up an interesting issue regarding Utah policy -- Should illegal immigrants in Utah be allowed to attend state colleges at in-state prices? If we as a country are truly ever going to make a stand against illegal immigration, than it must be said giving financial breaks to those who are in the U.S. illegally could definitely be viewed as counterproductive. On the other hand, one of the major arguments used by anti immigration activists groups is that illegals are simply importing poverty and crime from Mexico into the United States, which is often bred due to a lack of education. Without comprehensive reform being passed in Congress this year due to Hatch's amendment parade, this question may still be a difficult one to answer.

In my perfect world, I would like to see the state keep this law on the books -- but with a few modifications. Educated and intelligent immigrants breath new life into our nation, they take civic duty to heart and are actively engaged, usually, in living the American dream. Because this bill helps educate those who have immigrated to our country I believe this could also help as an incentive to attain citizenship. At the end of the road if an illegal has attended Utah colleges as an in-state student and they finish a Bachelor's degree the state should offer assistance to these students in order for them to attain legal citizenship. The state has paid the price to educate these people, and so the state (which often pines over the need for more college educated citizens) should hang on these people. This law is a powerful step in negating some of the most lamented negative impacts that illegal immigration has on America. However without offering citizenship at the end of the road, this law is not serving the state to its full potential.

Tuesday, June 27, 2006

Senate opens debate on Hatch flag amendment -- Stop the Madness

While the flag is a symbol of our nation - it is only a symbol. Another symbol of our nation is the right to speak out against the policies and actions of our leaders. Offensive as it may be, flag burning is an strong form of political speech. Our men and women of the armed forces have fought and died, not to defend the flag alone, but the freedoms that the flag represents.

Senator Hatch, freedom is the true symbol of our nation -- not the flag. The constitution has answered the question regarding flag burning -- it is a matter of free speech.

Saturday, June 24, 2006

Transportation Initiative -- Raise Sales Tax?

As a state with such a high tax burden I would have to say I would feel quite concerned if such a tax proposal was passed without some major efforts to finance such projects through the private sector. Revenue bonds (this is on memory from the last finance class I took 4 years ago) could be an excellent method of raising some of these funds --revenue bonds are paid from revenue received from the project that the debt was used to finance. In reference to my last post, offering the wealthy tax credits for contributing to such projects could be another means of coming up with the needed funds. I hope the legislature will continue to look at all options before lifting the states taxes.

However, if all else fails, a raise in sales tax may be a valid method of funding the project. With rising fuel and energy cost, the per capita monetary benefits of using mass transit could possibly justify the tax burden citizens would have to absorb for those who use mass transit.

That comment feels rather hypocritical for me. I often find myself commenting that Utah's conservatism ends when it comes to taxes.

Friday, June 23, 2006

Tax Reform -- the New Angle.

"The lion's share of the $70 million tax cut allocated to the flat-tax returns would assuredly go to the wealthiest of Utahns— who don't get that much of a tax benefit from the current system's deductions and exemptions.

You would see the wealthiest among us, those making $250,000 a year and more, eating up most of that $70 million tax cut because they would choose to pay the lower rate. I have a real problem with that, and so would many of my House colleagues," Curtis said.

This latest proposal seems to be a blatant "wealthy" only tax cut. Instead of at least keeping all tax payers using the same tax computations, middle class tax payers get to keep the same tax burden as before or they get to choose a method or pay more under the "fairer-flatter" tax. I wish the Governor would advocate for a more modest approach like that of Steve Urquhart:

"Tax reform may sound sexy, but it is not necessary," said Urquhart. "What we need this year is a tax cut, drop the top rate a bit. Our current tax system is good, except that it takes too much money from taxpayers."

If I had any influence whatsoever on the goings on in the legislature, I would advocate for either a simple rate reduction under the current system or meaningful tax credits under the current system at the current tax rate.

The credits I would propose would consist of a nonrefundable child tax credit that could adequately account for the rising cost of raising a family, a credit for education expenses incurred in reaching under graduate and graduate degrees, and a continuation of any and all vehicle energy credits (such as the Utah State hybrid vehicle credit that is expired for'06). For wealthy taxpayers who are often phased out of a great deal of these types of credits, offer charitable giving credits on a non-phased out limited dollar-for-dollar basis which could prove beneficial on a number of issues. For instance, Steve Urquhart suggested that wealthy citizens could be encouraged to donate funds to help the state provide dental insurance to the general public. Offering a non-phased out, limited dollar-for-dollar credit would be one means of encouraging such altruism among those who carry such a large tax burden in our state.

Thursday, June 22, 2006

My Worthless Blog

I got curious about other blogs in the Utah blogosphere and I found The World According to Me and SLCSpin topping out at a value of nearly 21,000 dollars each. Mozeltopf! That is only second to Alito's blog at nearly 25,000 dollars. Now the only question for Ethan and Bob is how to tap into those funds.

Happy Blogging!

Pandora is Sweet. Thanks Steve U.

I'm sure that Havaianas are cool to.

Gay Marriage -- Some of my thoughts after the debate.

1.) This issue cannot be totally in the states individual hands. There is one major all-encompassing reason that the Fed will have to define marriage. Every American has to file income tax returns and marital status can make a large difference in what the outcome will be on an individual income tax return.

2.)A full ban on gay marriage will never pass. Although the evidence is weak and sill far from full wide acceptance that gay behavior is fully genetic and natural, the rhetoric that gays are a oppressed minority has successfully become engrained in much of the American psyche. As such, there is no way I see a broad enough majority of lawmakers voting for something that might label them as homophobic bigot to amend the law of the land.

3.) A Charley Foster-esque compromise unfortunately will not be fool proof. Tax cases are some of the most frequent and heavily contested issues. Because of the tax issues alone, gay marriage legal in some states and banned in others is assured to see a major Federal Court decision.

4.) Federal court presidence (from what i understand) leans toward gay marriage legalization. I'm not a lawyer so I'm not going to quotes cases, but it seems like a majority of federal court cases strike down laws pertaining to bedroom activities between consenting adults.

Personally, while I am wholly opposed to gay marriage becoming an institution in our nation, I don't believe the battle to ban it will be a successful endeavor. Irritating as legalized abortion, this issue is one, I fear, that morality and wholesomeness will likely take a backseat.

Stenar has been writing about the BYU professor's firing. The professor was fired because he questioned the leaders of the Mormon church, an Stenar was miffed that his questioning leaders of the church that he is member of, and the church that operates the University where he teaches, led to his termination. Problem for that professor is LDS doctrine is expicit about supporting the leaders of the church, it is one of the major interview questions for temple recommends. Church doctrine has often stated that a lack of support for church leaders is a first step to apostasy from the LDS church. So as and American he is okay protesting LDS church official proclamations and doctrine, but as a Mormon he is definitely endangering his LDS membership.

However, because of a hypothetical issue, (a coworker brought this point up) it is surprising that the LDS supported the Amendment with one man one woman. The LDS church believes that polygamy is a law that God requires to be practiced in a place and manner he deems necessary, so hypothetically Mormons could some day be polygamists. Limiting marriage to one man and one woman might have been a hypothetical bullet through their foot.

Tuesday, June 20, 2006

Lobby for a Siesta Patterned Workweek

I'm sitting in my office with blinds closed, and its sweltering. I can only imagine how bad it must be for those that work for a living. I guess I need to get a petition going.

Correction: Brigham Young's quote I think is likely more attributable to the cursing Apostle J. Golden Kimball. I still can't find any written citation of it.

Thursday, June 15, 2006

Charley Foster answers the Question of the Marriage Amendment

"If the federal courts threaten to take the question away from the several states, I say then pass an amendment giving the question to the states once and for all."

I know that this solution would not totally please the LDS church hierarchy, who for many years have been quite candid on this issue. However such an amendment would solve the concern that Federal court decisions could overrule state approved constitutional amendments. The amendment wouldn't (as Democratic senators alledged) chisel bigotry into the US constitution, but it would allow right leaning states to decide the issue how they wanted and left leaning states can allow gay marriage if they like.

The only Federal question I see is what marriages will the Treasury Department recognize for income tax purposes. If they allow individual state laws to rule, then alot of recognized marriages in some states would be nullified if the couple moved. If the Fed decided any marriage will be recognized no matter where it is solomnized, than states right will still be overruled. The Fed will still have to answer this question, what will marriage be defined as?

Charley rules!

Monday, June 12, 2006

Amnesty will not be cheap.

A comprehensive immigration reform bill passed by the Senate last month has run into constitutional trouble over some tax provisions. S. 2611, the Comprehensive Immigration Reform Act of 2006, was introduced by Senate Judiciary Committee Chairman Arlen Specter (R-PA) and passed the Senate on a 62-36 vote. If signed into law, the bill would increase border security, expand a guest-worker program, and offer illegal immigrants a path to citizenship based on certain requirements. In order to better enforce hiring laws, the bill would require the disclosure of certain taxpayer information by employers and certain government agencies. Additionally, and most importantly for enrolled agents, while S. 2611 would require illegal immigrants to pay back taxes, it would bar them from claiming any tax credits for past years.

The enactment of a tax provision by the Senate while not only unconstitutional, would prove expensive for illegals seeking amnesty that are required to file past tax returns. These "guest" workers, often have several children and I'm guessing most of them don't have itemized deductions. Citizens get a 1000 dollar tax credit per child, for which a married family of 3 would with income of 40,000 dollars could escape the Federal government tax free. Without the child tax credits they are assured of paying a tax of at least 1500 dollars less interest and tax penalties.

I'm glad to see this provision, because it does require illegals to pay taxes that they owed without giving tax credits that often produce tax refunds for lower-middle income tax payers. Even if I feel that amnesty is wrong, at least guest workers will pay their share of income tax. If only the government could secure the border and make citizenship a 2 year, monitarily affordable, lawyerless proposition.